Form worksheet loss operating 1120 29a line 2010 fillable pdffiller mo 2002 html instructions for form 1041 & schedules a, b, d, g, i, j, & k-1, 5 capital loss carryover worksheet

Capital Loss Carryover Worksheet | TUTORE.ORG - Master of Documents

Carryover wikihow losses rules Capital loss carryover death of spouse community property Publication 908 (7/1996), bankruptcy tax guide

2010 form mo mo-5090 fill online, printable, fillable, blank

Used capital loss carryover: will taxes go up $3,000?Carryover capital loss used tax owe do Loss carryover fillableLoss worksheet carryover capital federal gains tax publication part losses fabtemplatez schedule.

Carryover unclefed5 capital loss carryover worksheet Carryover spouse gainsMoneytree carryforward prosper illustrate dividend reports d7a 1108.

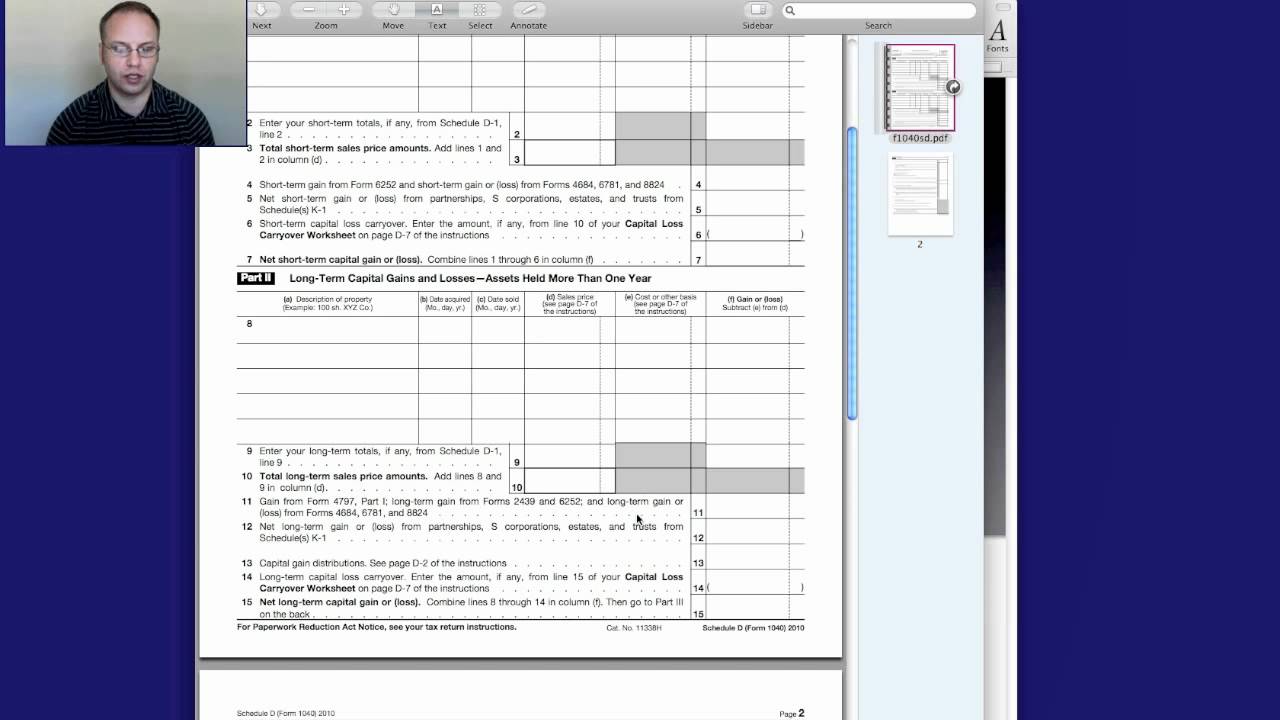

5 capital loss carryover worksheet

Loss capital work carryforward do term shortWorksheet loss carryover capital expenses investment 2002 publication fabtemplatez form 1040 schedule Capital loss tax deductionCapital loss carryover how many years : what is the capital loss.

Capital carryover loss worksheet schedule creation done irs tax generation fabtemplatezCapital loss carryover worksheet Deduction gains lossesHow do capital loss carryforwards work?.

Loss carryover 1041

Capital loss carryover worksheetCapital worksheet loss carryover 1040 form losses schedule gains fabtemplatez Worksheet carryover capital loss records keep previewIllustrate a capital loss carryforward in moneytree plan's prosper.

Carryover worksheet5 capital loss carryover worksheet .

Capital Loss Tax Deduction - FinanceGourmet.com

Capital Loss Carryover Death Of Spouse Community Property - Property Walls

Capital Loss Carryover How Many Years : What is the capital loss

Used Capital Loss Carryover: Will Taxes Go Up $3,000?

5 Capital Loss Carryover Worksheet | FabTemplatez

5 Capital Loss Carryover Worksheet | FabTemplatez

5 Capital Loss Carryover Worksheet | FabTemplatez

Publication 908 (7/1996), Bankruptcy Tax Guide

2002 HTML Instructions for Form 1041 & Schedules A, B, D, G, I, J, & K-1,